Lets face it, when playing the Powerball the odds are not in your favor. However, with a little mathematics, we can figure out when it is actually “worth it” or financially justifiable to buy a $2 Powerball ticket. As well all know, nobody in their right minds will pay $10 bucks for only a 20% chance that you will win $20, but with the Lottery system, well, it actually works quite like that. In order to find out when the value of a ticket outweigh the odds of losing, we first have to do a little mathematics… In order to find out when the Powerball is worth buying a ticket, we must find out what the Expected value is of your chances. To calculate Expected Value (EV) we use the following formula:

E[X]= x1p1 + x2p2 + x3p3 +… + xnpn

For those who do not remember algebra, X is a random variable that can have values x1, x2… with the corresponding probabilities of p1, p2 and so forth. So using my $10 example, the expected value of the bet is -$10(.80) + $20(.20) = -$4. So each time play, you are expected to lose a value $4.00 for each $10 bet. Lets look at it calculation playing 1 number in roulette. The roulette wheel has 38 spaces and the casino pays out 36:1 when your number hits. So if the ball lands on your number you win $35, if it lands in any of the 37 other numbers, you lose your $1 bet. The EV of that $1 bet would be:

E[$1 bet] = $-1 * 37/38 + $35 * 1/38 = $-0.053

The odds of winning the Powerball is 1 in 292,201,338.00 or .0000003422% The equation is .000000003422X = $2 After solving for X you get $588,235,294.00

Now we may think that $588M is the correct number but NOPE! there are 3 things we mathematically need to factor in. Powerball values are amortized at about 3.2% for 30 years ahead of today’s date because the original jackpot is paid out in 30 parts once per year. This means that if you have an investment vehicle that is higher than 3.2%, then you should take the cash option rather than the annuity. The cash option of the Powerball is about 3/5th of the jackpot or 62.78%, Federal and state taxes average around 42%, and when there are over 500 million tickets sold the “value” goes down about 37% respectively due to the odds becoming in favor of multiple winners. After all, there are only 292, 201,338 different ticket combinations. The less tickets sold the higher expected value of your ticket but lets keep it at 500 million to use as a constant rather than inserting a variable. To add these factors in we must divide the 588M by what you keep in your taxes at 58% (1-.42) = $1,014,199,828. Now you take that number and factor in the 37% chance someone else wins which means you keep 63% (1-.37) So 1.104B/.63 is 1.609,838,530, Lastly, since the jackpot is actually the present value of a higher number 20 years down the road, you must divide it by the 62.79% cash value of what you can keep all at once. So 1.6B/.6279 = 2,563,85,410.00 So basically the Powerball has never been worth buying.

Even when it was at 1.5B this past January, the expected value was not in our favor.

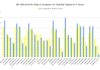

FACTORING IN THE OTHER PAYOUTS

Now looking at this graph we do know that Powerball has other prizes but it doesn’t really change the expected value that much. The “break even” jackpot is actually a little lower! There are, after all, plenty of other payouts at stake as you see in this graph. In order to make the adjustments, it’s helpful to find out how much they’re worth, again by finding their expected value. Adding up the expected values for all those prizes absenting the jackpot comes to $0.24 (for each prize: Prize x probability+prize x probability + etc.). So the jackpot’s contribution to the total expected value of a Powerball ticket can drop $.24. Since a ticket costs $2, we only need the jackpot’s portion of the ticket’s expected value to be $1.76 in order to have a a ticket that’s worth what it costs and a break-even analysis.

So since we know we need the expected value of the jackpot’s portion a Powerball ticket’s worth ($1.76) before adjusting for cash value, we can find out how big the jackpot needs to be, just like we did in first version. By dividing the $1.76 by the probability of hitting it big, adjusting for taxes, adjusting for jackpot splitting, you get… $1,416,658,620. But this is just the cash payout, which is usually three-fifths of the jackpot. so divide the 1.41B/.6279 = $2,256,185,090.00 or 2.25B.

So this means you need a payout of 2.25 Billion dollars in order to making the value of a Powerball ticket financially justifiable or worth buying!

In conclusion I myself am a dreamer and I believe that most people are. There is nothing like the idea of riding off into the sunset! I am not going to wait until until the lottery hits $2.25 Billion in order for me to dream! There might not be a better feeling to win big, tell your boss off, and kiss our 9-5 days of work slavery goodbye! Everyone has their own number when they believe the Powerball is worth it to them to pay that $2.00. The question is, what is your expected value?